Trading is often described as a journey, and like any journey, it has its challenges, rewards, and unique landscapes to navigate. As traders, you’ve likely honed your skills in risk management, crafted a well-defined trading strategy, and learned valuable lessons from trading legends like Mark Douglas. However, in this article, we’re going to delve into a topic that’s both the bane and boon of every trader: market volatility.

Market volatility, characterized by price fluctuations and unpredictable movements, is the trader’s ever-present companion. It can be both your best friend and your worst foe, depending on how you approach and harness its power. Let’s explore how to navigate these market waters and use volatility to your advantage.

The Nature of Market Volatility

Before we dive into strategies for handling market volatility, let’s first understand its nature. Market volatility is driven by a multitude of factors, such as economic events, geopolitical developments, and unexpected news. It can cause asset prices to swing wildly, often leading to rapid price changes and increased trading volumes.

As a trader, it’s crucial to recognize that market volatility is a double-edged sword. While it can offer profitable opportunities, it can also expose you to higher levels of risk. Embracing this fact and learning to manage it effectively is key to success.

Mastering Volatility with Risk Management

We’ve touched on risk management strategies in previous articles, but in the context of market volatility, these principles become even more critical. Volatile markets can lead to larger price gaps and unexpected reversals, making it essential to safeguard your capital.

- Position Sizing: Adjust your position sizes to account for increased volatility. Smaller positions can help mitigate the risk of large losses during turbulent market conditions.

- Stop Loss Orders: Utilize stop loss orders to protect your trades. Consider using wider stop losses to allow for market noise, but always maintain a risk-reward ratio that suits your trading strategy.

- Diversification: Diversify your trading portfolio to spread risk. Different assets may react differently to volatility, and a well-diversified portfolio can help maintain stability.

Adapt Your Strategy

In the ever-changing landscape of trading, a well-defined strategy is invaluable. However, strategies that work in calm markets may not fare as well during volatile times. Here are a few adjustments you can make:

- Intraday Trading: Consider switching to shorter timeframes for quicker entries and exits. Short-term trading strategies are better suited to capitalize on rapid price movements.

- Safe Havens: During times of increased volatility, safe-haven assets like gold or the Japanese yen often see increased demand. Incorporating these assets into your trading strategy can provide stability.

- News Awareness: Stay informed about economic news and events that can trigger volatility. This will help you anticipate market movements and make more informed decisions.

Volatility as an Opportunity

While volatility can be a source of concern, it’s also a wellspring of opportunity for savvy traders. Here’s how you can use market volatility to your advantage:

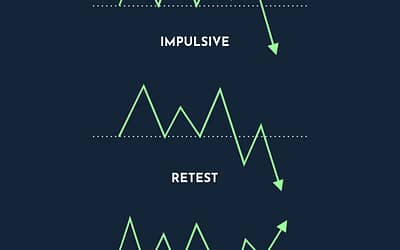

- Breakout Trading: Volatile markets are more likely to produce significant price breakouts. Mastering breakout strategies can help you capitalize on these movements.

- Volatility Indicators: Use volatility indicators like the Average True Range (ATR) to gauge market volatility and set appropriate stop losses and take profits.

- Volatility Expansion: Volatility often precedes larger price movements. Keep an eye out for volatility contractions followed by expansions, as this can signal potential trade setups.

Embracing the Journey

Market volatility is an integral part of a trader’s journey. It can be a challenging companion, but with the right approach and strategies, you can transform it from a foe into a friend. Remember that there is no one-size-fits-all solution to trading in volatile markets, and your approach should align with your risk tolerance and trading style.

As you navigate the trading waters, continuously adapt, learn from experiences, and stay patient. The road to trading success is marked by both calm seas and stormy waters, and it’s the ability to adapt and persevere that separates successful traders from the rest. Embrace market volatility as an opportunity, and you’ll find that it can be a powerful ally on your trading journey.

Conclusion

In the world of trading, market volatility is both a challenge and an opportunity. It requires a delicate balance of risk management, strategy adaptation, and the ability to seize opportunities when they arise. As a trader, your success depends on your ability to navigate the unpredictable waters of the market, using market volatility as a tool to achieve your financial goals. Remember, with the right knowledge and approach, market volatility can indeed become your best friend, helping you unlock new trading possibilities and, ultimately, trading success.

0 Comments